Billing for Psychological and Neuropsychological Testing

Psychological and neuropsychological testing provides immense clinical value, informing diagnoses, guiding treatment planning, documenting disability, and answering complex questions about cognitive functioning, personality structure, and clinical presentation. Yet many practitioners avoid testing entirely or lose money on assessments because they lack knowledge about proper billing procedures, documentation requirements, and practice management strategies that make testing financially sustainable.

Understanding testing billing isn't just about maximizing revenue; it's about ensuring that valuable assessment services remain available to clients who need them. When practitioners consistently underbill or can't make testing financially viable, they stop offering these services, reducing access to essential diagnostic tools. Conversely, practitioners with solid billing knowledge can provide comprehensive assessments, get appropriately compensated for complex work, and maintain testing as a sustainable component of their practice.

Understanding Testing CPT Codes: The Foundation of Proper Billing

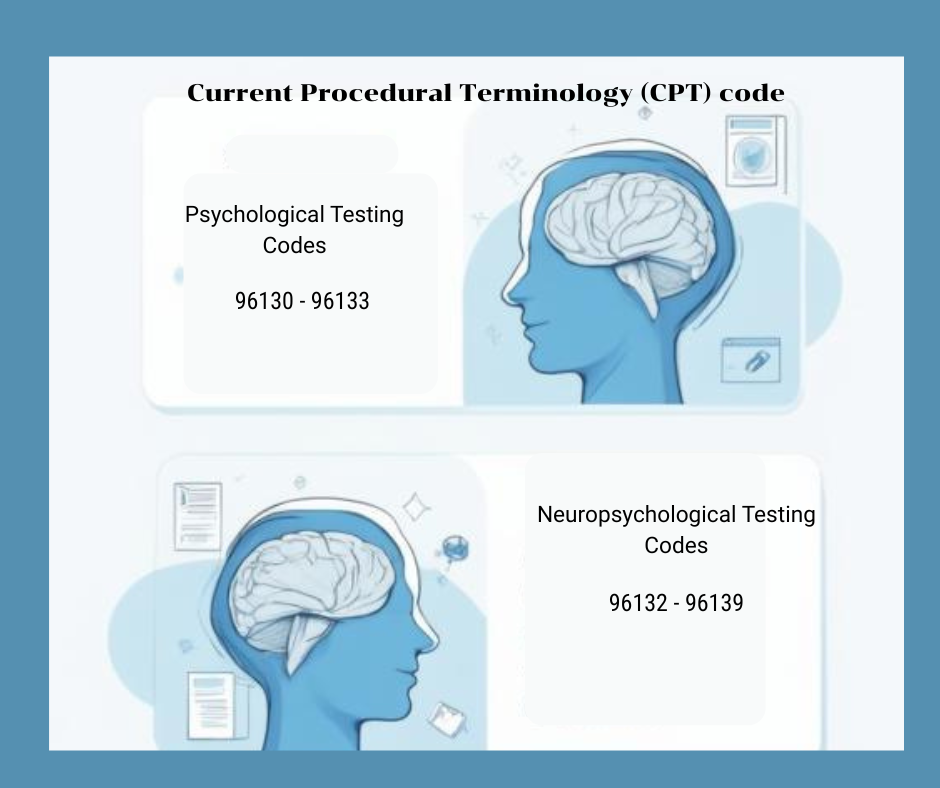

The Current Procedural Terminology (CPT) code system for psychological and neuropsychological testing was revised in 2019, creating distinct codes for different aspects of assessment work. Understanding these codes and when to apply them is fundamental to accurate billing.

Psychological Testing Codes (96130-96133) apply to evaluations that primarily assess emotional, behavioral, or personality functioning. These assessments might include measures of depression, anxiety, personality disorders, adaptive functioning, or behavioral concerns. The codes distinguish between test administration and test evaluation:

96130: Psychological testing evaluation services by a physician or other qualified healthcare professional, including integration of patient data, interpretation of standardized test results, clinical decision-making, treatment planning, and report. First hour.

96131: Each additional hour (beyond 96130)

96136: Psychological testing administration and scoring by a physician or other qualified healthcare professional. First 30 minutes.

96137: Each additional 30 minutes (beyond 96136)

Neuropsychological Testing Codes (96132-96139) apply when evaluating brain-behavior relationships, cognitive functioning, or neurodevelopmental issues. These assessments address questions about learning disabilities, attention disorders, dementia, traumatic brain injury, or other conditions affecting cognitive functioning:

96132: Neuropsychological testing evaluation services by a physician or other qualified healthcare professional, including integration of patient data, interpretation of standardized test results, clinical decision-making, treatment planning, and report. First hour.

96133: Each additional hour (beyond 96132)

96136: Neuropsychological testing administration and scoring by a technician. First 30 minutes.

96137: Each additional 30 minutes (beyond 96136)

96138: Psychological or neuropsychological test administration and scoring by a physician or other qualified healthcare professional. First 30 minutes.

96139: Each additional 30 minutes (beyond 96138)

The key distinction is between evaluation services (interpretation, integration, report writing, treatment planning) and administration/scoring (face-to-face testing time, scoring protocols). Most comprehensive assessments involve both components, with evaluation codes capturing the professional interpretation work and administration codes capturing direct testing time.

Understanding when to use psychological versus neuropsychological codes requires clinical judgment about the primary referral question. An evaluation for ADHD would typically use neuropsychological codes, while an evaluation for personality disorders would use psychological testing codes. When assessments address both domains, practitioners should code based on the predominant focus of the evaluation.

Professional development in assessment practices often includes billing education, recognizing that technical knowledge without billing competence limits testing accessibility.

Documentation Requirements: Building Audit-Proof Records

Proper documentation protects against audits and provides clear justification for billed services. Insurance companies and Medicare increasingly scrutinize testing claims, making thorough documentation essential.

Medical Necessity Justification

Every testing claim must demonstrate medical necessity and explain why this assessment is needed at this time for this client. Documentation should include:

The specific clinical question the testing will answer

Why can't this question be answered through less intensive means (clinical interview, rating scales)

How testing results will inform treatment planning or clinical decision-making

The specific tests selected and why they're appropriate for this client and referral question

Generic statements like "testing requested to clarify diagnosis" provide inadequate justification. Strong medical necessity documentation might state: "Patient presents with declining work performance, memory complaints, and family concerns about cognitive changes. Testing is needed to differentiate between major depressive disorder with cognitive symptoms versus mild cognitive impairment, as the treatment approach differs substantially. Selected measures will assess memory, executive functioning, processing speed, and emotional factors to clarify the diagnostic picture."

Session Notes for Testing Days

Each testing session requires documentation of time spent, activities completed, and clinical observations. These notes should specify:

Start and stop times for each activity

Tests administered during the session

Behavioral observations relevant to interpretation

Any breaks taken (which shouldn't be billed)

Time spent on scoring completed that day

Detailed time tracking proves essential for billing accuracy and audit defense. Many practitioners use timer apps or detailed logs to track time spent on different assessment components.

Integrated Reports

The final assessment report represents the evaluation service being billed through codes 96130/96132 and their add-on codes. These reports must synthesize all data collected, test results, clinical interviews, collateral information, and behavioral observations into coherent clinical narratives that answer referral questions and provide actionable recommendations.

Reports should clearly document:

All data sources considered in the evaluation

How specific tests relate to clinical questions

Integration of test findings with other clinical information

Clear diagnostic conclusions supported by evidence

Specific, actionable recommendations

Time spent on report preparation and interpretation work

The report itself provides evidence of the complex cognitive work justifying evaluation codes. Sparse, disorganized, or template-driven reports may trigger questions about whether evaluation services were actually provided.

Documentation for Appeals

When claims are denied, detailed documentation is your strongest tool for appeal. Maintain records showing exactly when testing was conducted, how time was spent, what clinical judgments were made, and why services were medically necessary. This documentation should be contemporaneous, recorded when services were provided rather than reconstructed later.

Understanding ethical assessment practices includes recognizing that thorough documentation serves both clinical and administrative purposes.

Ethical Considerations: Balancing Financial Viability and Access

Proper billing creates ethical tensions between receiving appropriate compensation for complex work and ensuring testing remains accessible to clients who need it.

1. Financial Viability

Testing requires significant time, expensive materials, specialized training, and complex professional judgment. Practitioners who consistently underbill eventually stop offering testing services because they can't afford to provide them. This reduces access to essential assessment tools, harming the broader clinical community and clients who need comprehensive evaluation.

Billing appropriately isn't about greed; it's about ensuring valuable services remain available. When practitioners charge sustainable fees and bill accurately for time spent, they can continue offering testing without subsidizing these services through other income sources.

2. Sliding Scales and Access

While appropriate billing matters, so does access for clients with limited financial resources. Many practitioners implement sliding-fee scales for testing services, offering reduced rates based on income while maintaining higher standard fees to support overall practice sustainability.

Creating tiered pricing, standard fees for those who can afford them, reduced fees for those with financial need, and occasional pro bono assessments for those unable to pay balances financial sustainability with access values.

3. Transparency About Costs

Clients should understand testing costs before beginning evaluation. Providing clear estimates (acknowledging that exact costs depend on the time required, which isn't always perfectly predictable) enables informed decisions about whether to proceed, seek out-of-network reimbursement, or explore alternatives.

Surprise bills after testing completion damage therapeutic relationships and create financial hardship. Upfront transparency, even when conversations about money feel uncomfortable, demonstrates respect for clients' financial autonomy.

4. Insurance vs. Private Pay

Some practitioners offer lower self-pay rates than insurance reimbursement covers, while others charge higher self-pay rates to offset underpayment by insurance on other services. These decisions involve ethical considerations about fairness, transparency, and economic sustainability.

There's no single right answer, but practitioners should deliberate on fee structures rather than arbitrarily setting rates or simply accepting whatever insurance companies pay.

Professional ethics training increasingly addresses financial dimensions of practice, recognizing that ethical practice includes sustainable business practices.

Resources and Continuing Education

Billing rules, insurance policies, and CPT codes evolve regularly. Staying current requires ongoing education and access to resources that provide up-to-date information.

Key resources include:

American Psychological Association Practice Organization billing guidance

National Academy of Neuropsychology practice resources

Specialty billing consultants who understand mental health testing

Professional listservs where practitioners discuss billing challenges

Many practitioners benefit from consultation with billing specialists when developing testing services or troubleshooting persistent billing problems. The cost of consultation is often quickly recovered through improved billing accuracy and fewer denials.

Building a Sustainable Testing Practice

Psychological and neuropsychological testing provides immense clinical value, but only when practitioners can offer these services sustainably. Mastering testing billing, understanding codes, tracking time meticulously, documenting thoroughly, navigating insurance systems, and managing practice finances transforms testing from a loss leader into a viable practice component.

Small improvements in billing accuracy and efficiency compound over multiple evaluations, potentially adding thousands of dollars annually to practice revenue while ensuring testing services remain available to clients who need them. Investing in billing expertise supports both your practice's sustainability and your clients' access to comprehensive, high-quality psychological assessment.

Ready to expand your clinical toolkit? Explore our continuing education courses designed specifically for mental health professionals.